Every high intent buyer journey begins with discovery, comparison, and social proof. SaaS directories bundle those moments in one place. They help you earn qualified traffic, reviews, and backlinks while shaping brand perception well before a demo.

The challenge is not whether directories work but which ones are worth your time at your stage, and how to operationalize submissions so they drive pipeline and SEO rather than busywork.

In this guide, we will map the landscape, show how to choose, and provide a repeatable playbook you can use globally. Throughout, you will see the phrase best saas directories used in context so you can evaluate platforms against your goals rather than following generic lists.

What Counts as a SaaS Directory

A SaaS directory is a curated place where buyers can browse categories, compare tools, and in many cases read and write reviews.

Some directories are review led and built for in market buyers. Others are launch first and designed for initial awareness and community validation. There are also data directories that help investors and press understand companies and momentum.

Knowing the type matters, because you measure success differently on each and you will optimize your listing accordingly.

How this guide is organized

First we break down directory types and selection criteria. Then we review the most influential platforms and when to use them.

Next you get a comparison table, a practical submission and review playbook, mistakes to avoid, and an FAQ that answers the most common searches like what are the best saas directories and which saas directories list software.

If you are short on time, skim the key takeaway boxes placed at 20, 40, 60, and 80 percent of the content.

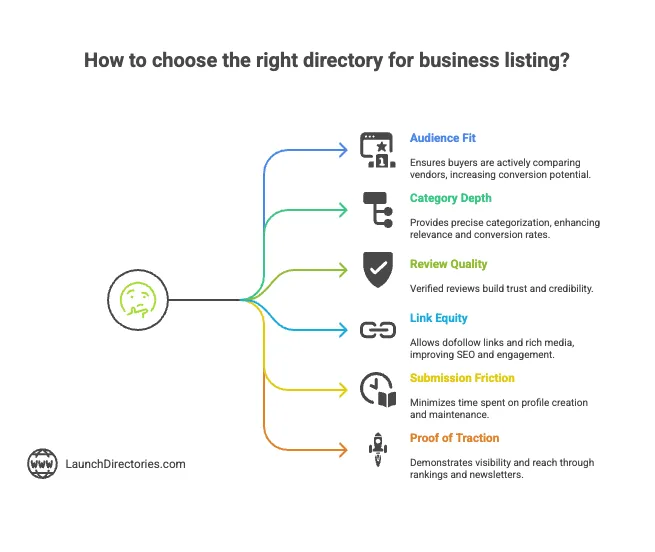

What to look for when choosing a directory

Audience and intent fit Are buyers actively comparing vendors or just browsing new launches

Category depth and taxonomy The more precise the category, the higher the relevance and conversion

Review quality and verification Verified reviews carry more weight than unverified star ratings

Link equity and profile completeness Some profiles allow dofollow links, rich media, and product updates

Submission friction and maintenance Factor the time to create and maintain profiles and respond to reviews

Proof of traction Check signals like category rank pages, top lists, and newsletter reach

🔑 Key Takeaway Choose directories by intent fit first, then by category depth and review quality. A smaller, high intent directory in your exact niche will outperform a broad list that does not match your buyers.

with 100+ Directory Listings

Skip the grind. We'll submit your product to top directories so you get real users, feedback, and lifetime backlinks without lifting a finger.

The major directory types and when to use each

The best saas directories fall into four groups. Think of them as different channels in your go to market, not substitutes.

1. Review led marketplaces

These are built around verified peer reviews and robust category pages. If you need bottom of funnel trust, they are essential. A well optimized profile with a steady cadence of reviews will lift category rank pages, branded search click through rate, and win rate against your competitive set.

G2 remains a dominant review marketplace with deep category coverage and comparison tools that buyers reference in later stage evaluations. (G2)

Capterra emphasizes verified reviews and comparison workflows, which makes it a reliable stop for small and mid sized buyers. Their materials reference 2.5 million plus verified reviews that buyers rely on during evaluation.

TrustRadius positions around in depth, enterprise friendly reviews and category navigation that helps buyers understand pros, cons, and fit. It is especially useful for complex B2B categories where long form feedback matters.

When to prioritize review led marketplaces

You have product market fit and active customers willing to review

You are in a competitive category where prospects ask for comparisons

You want SEO lift from category and alternative pages that rank for high intent keywords

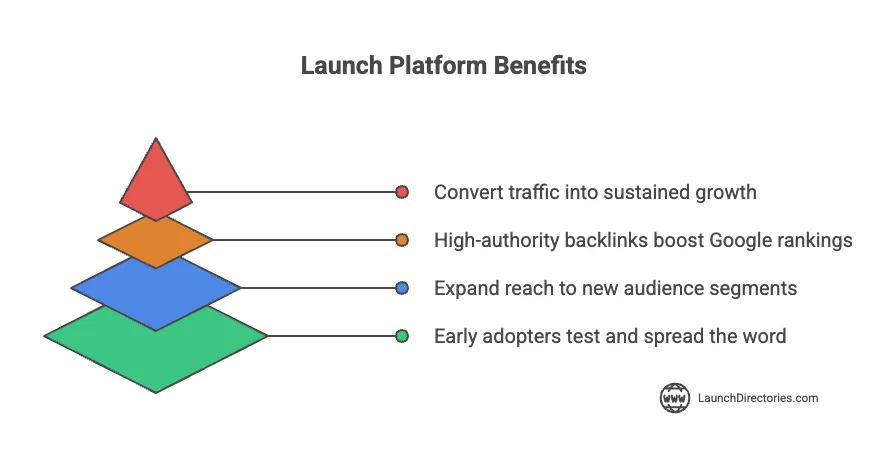

2. Launch and community platforms

These platforms help with announcement momentum and early adopter discovery. The traffic is spiky but can generate sustained compounding if you convert that attention into owned assets and follow up sequences.

Product Hunt is still the most visible daily launch hub for new products across categories. It offers launch guides, forums, and category navigation that send qualified traffic when you plan a high quality launch with clear positioning and assets.

TinyLaunch is a lightweight alternative aimed at solo founders and small projects. Its community is smaller and less noisy than PH, which makes it easier for niche products to stand out. Launches that reach the top 3 get dofollow backlinks, which is valuable for SEO and long-tail discovery.

UneedBest positions itself as a democratic Product Hunt alternative with a fast-growing community. It runs daily launches across multiple categories and has features like vote multipliers, daily lotteries, and homepage promotions. It generates significantly more traffic than niche directories, which makes it a good option for broader awareness and sustained visibility.

When to prioritize launch platforms

You are releasing a new product, a major version, or a significant category move

You can assemble a compelling launch package with visuals, a demo, and a crisp hook

You are ready to turn attention into email signups, trials, and customer interviews

3. Alternative and comparison directories

These are discovery surfaces where buyers search for a product and then browse alternatives. They are great for intercepting users switching away from incumbents.

- AlternativeTo is a crowdsourced index built around the idea of alternatives. It helps capture searches like “tool X alternatives” and exposes your product to migration-ready buyers.

- AppSumo is a deal-driven marketplace where software is promoted with lifetime or heavily discounted offers. While it’s not only about alternatives, it attracts budget-conscious users actively looking to replace or add tools. A strong listing there can generate spikes of new customers and long-tail awareness through reviews and word of mouth.

When to prioritize alternative sites

You have a clear displacement story or migration pathway from mainstream competitors

You offer a freemium or low friction trial that makes switching easier

You can write tight, benefit forward copy that maps to competitor pain

4. Company and data directories

These are not classic review directories, but they shape perception with press, analysts, and partners. They also supply high authority citations that can strengthen your brand knowledge graph.

Crunchbase maintains extensive private company data and has leaned into predictive intelligence about funding and growth. A complete profile helps third parties validate your existence, leadership, and milestones. (Crunchbase)

When to prioritize data directories

You are fundraising, hiring, or pursuing partnerships

You want journalists and analysts to find credible company references

You need a central source for company facts that other sites will cite

🔑 Key Takeaway Match directory type to outcome. Use review marketplaces for conversion trust, launch hubs for awareness spikes, alternative sites to intercept switchers, and data directories for authority signals.

Quick comparison of directory types and outcomes

Use the table below to map goals to platforms. Ratings are directional and meant to support planning. Your mileage will vary by category maturity, messaging quality, and review velocity.

| Directory type and example | Primary outcome | Review centric | Speed to value | Maintenance load | Typical costs |

|---|---|---|---|---|---|

| G2 style review marketplace | Trust and late stage conversion | High | Medium | Medium to high | Free profile plus paid options |

| Capterra style review marketplace | Category discovery and comparison | High | Medium | Medium | Free profile plus paid options |

| TrustRadius style enterprise reviews | Deep evaluation for complex B2B | Very high | Medium | High | Free profile plus paid options |

| Product Hunt style launch hub | Awareness spike and community validation | Low | High | Low to medium | Free profile, optional paid placements |

| AlternativeTo style comparison site | Competitive intercept and migration leads | Low | Medium | Low | Free profile |

| Crunchbase style company data | Authority citations and PR readiness | None | Medium | Low | Free profile plus paid data access |

How to operationalize directory submissions

Submitting to a directory should not be a one off task. Treat it as a small lifecycle program.

Step 1. Create a single source of truth

Package the assets every directory will ask for so you can submit once and adapt quickly.

Company summary at 50, 100, and 200 words

Category specific messaging and top 3 differentiators

Logo in square and horizontal versions plus two screenshots and a 30 second demo

Pricing summary and plan names

Founder bios, founding year, location, and industries served (especially important if you’re positioning as a startup rather than an indie project)

Step 2. Prioritize by intent and category fit

Pick two to three review led marketplaces, one launch platform for your next milestone, one alternative site, and one company data directory. That gives you a balanced portfolio without spreading thin.

Step 3. Submit and optimize in sprints

Batch the first wave of submissions into a two week sprint. After approval, schedule small weekly improvements for eight weeks. Examples include adding more screenshots, tightening headlines, or answering new questions.

Step 4. Build a durable review engine

Reviews do not appear by magic. Create ethical, customer first prompts that fit natural touchpoints.

For example, ask after a support resolution that ended in high satisfaction, after the second value event in onboarding, or after a successful QBR. Rotate which marketplace you ask for to keep velocity balanced.

Offer value like educational content or exclusive webinars, not cash or gift cards that can bias results.

Step 5. Track leading indicators

Profile completeness and image coverage

Category rank movement and traffic from category pages

Review velocity and average rating trend

Assisted conversions showing directory influenced deals

SEO metrics like impressions on alternative and compare queries

🔑 Key Takeaway Treat directories like a lifecycle program. A two week submission sprint followed by eight weeks of steady optimization and review flow will outperform one time pushes.

Detailed walkthroughs by directory type

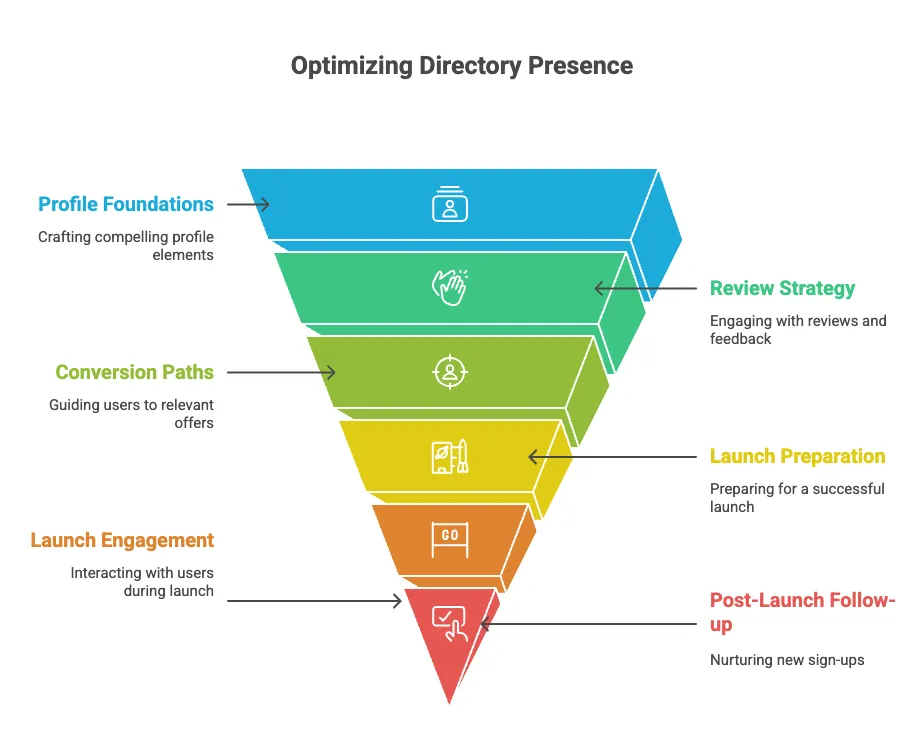

Review led marketplaces

Profile foundations

Nail the first two lines of copy. Buyers skim, then dig deeper if the hook lands.

Use feature benefit bullets and a crisp ICP statement.

Map integrations and security badges clearly.

Add three screenshots that show the aha moment, not just a dashboard.

Review strategy

Define two to three moments for ethical review asks and rotate the marketplace you send people to.

Respond to every review within 72 hours to show you are engaged and to add context.

Build a quarterly cadence for customer stories you can link to from your profiles.

Conversion paths

Use UTM parameters on profile CTAs to track downstream conversion.

Route traffic to the most relevant offer. For complex B2B, that might be a problem led landing page rather than a generic homepage.

Launch and community platforms

Before the launch

Recruit early supporters and beta users to comment with real use cases.

Polish your thumbnail, tagline, and the first three screenshots.

Prepare a short, authentic story from the founder.

On launch day

Keep your team in a private channel to coordinate replies.

Answer questions quickly and be specific about who it is for and not for.

Share one or two proof points as comments rather than as edits to the original post.

After the launch

Ship a thank you note to everyone who engaged and invite them to a changelog or community.

Turn the thread into a learnings post and a short video recap for LinkedIn and email.

Move new signups to an onboarding sequence that references the launch and the promise you made.

Alternative and comparison directories

Positioning

Lead with what makes you different from the incumbent your buyers are trying to replace.

Include a one sentence migration claim like Imports your X in under 5 minutes.

List two to three headline alternatives your ideal customer is likely to search.

Copy hygiene

Avoid generic feature lists. Make it obvious who should pick you and why now.

- Use verbs in bullet points and front load outcomes.

🔑 Key Takeaway Each directory type rewards a different behavior. Reviews reward steady, ethical asks. Launch hubs reward narrative and speed. Alternative sites reward clear displacement stories. Data directories reward accuracy.

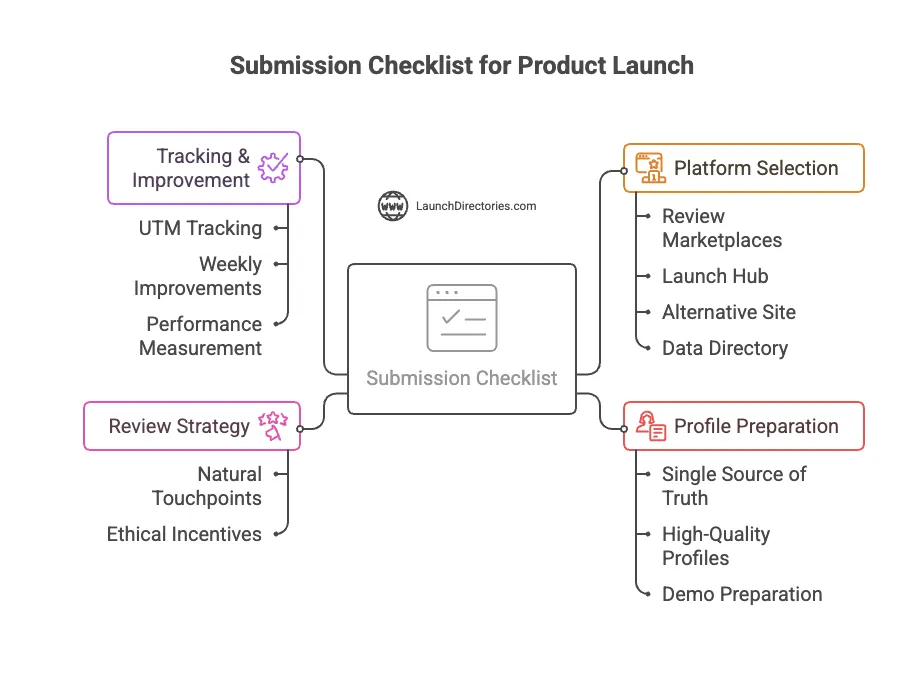

The submission checklist you will actually use

Print this or paste it in your task manager.

Confirm ICP and category fit

Pick 2 or 3 review marketplaces, 1 launch hub, 1 alternative site, and 1 data directory

Prepare a single source of truth with copy, assets, and links

Submit high quality profiles with screenshots and a 30 second demo

Plan review asks at three natural touchpoints

Add UTMs and track profile traffic to trial or demo

Schedule weekly profile improvements for eight weeks

Measure rank movement, review volume, and assisted conversions

Revisit category and messaging every quarter

Common mistakes to avoid

Chasing every list instead of fitting platforms to goals

Thin profiles with generic text and missing screenshots

Unethical incentives that risk review takedowns and trust loss

No tracking which makes it impossible to see impact

Set and forget profiles that age poorly and slip in rank

Ignoring alternatives so you miss buyers who are actively seeking a switch

Which specific platforms should be on your shortlist

There is no single universal short list. Your shortlist depends on product maturity, category, and motion. That said, the platforms below consistently appear on buyer journeys and deserve strong consideration.

G2 for broad buyer reach and comparison workflows in later stage evaluations.

Capterra for verified reviews and intuitive side by side comparisons that appeal to small and mid sized buyers.

TrustRadius for long form, enterprise ready reviews that highlight pros, cons, and fit.

Product Hunt for time boxed awareness spikes and community validation at launch or major version releases.

AlternativeTo for capturing switch intent on alternative searches and comparison discovery.

The review and listing playbook by company stage

Pre launch and early alpha

Focus on message market fit first.

Soft list on one alternative site to start capturing waitlist signups.

If you have testers, collect qualitative feedback and a few public quotes to use at launch.

Public launch

Plan a Product Hunt launch with a clear promise, a quick demo, and active founders in the thread. Invite early supporters to share their genuine use cases, not generic praise.

Repurpose the launch into a blog post, a founder thread, and a changelog entry.

Add an AlternativeTo profile that positions you against the incumbent most users are replacing.

Post launch momentum

Open or polish profiles on two review marketplaces. Seed your first 10 to 20 reviews by asking customers at natural moments.

Start a quarterly customer story cadence and link those assets from your profiles.

Track category rank movement and traffic influence on trials and demos.

Growth stage

Tighten ICP language and category mapping.

Expand review asks to a sustainable pace that matches customer volume and avoids overwhelming any one marketplace.

Explore paid enhancements only after strong organic fundamentals are in place.

Enterprise motion

Prioritize TrustRadius style long form reviews that address risk, integration, and support concerns.

Add detailed security and compliance sections to profiles.

Feed sales with category comparison pages and case studies linked from profiles where allowed.

Measuring impact with a simple scorecard

Keep it simple. Revisit these metrics monthly:

Profile completeness and category rank

Review velocity and percentage of reviews that mention outcomes

Click through rate from profile CTAs

Trials, demos, or signups attributed to directory traffic

Assisted revenue influenced by directory sourced sessions

SEO impressions for alternative and comparison queries

If any metric stalls, run a two week improvement sprint that targets copy, assets, or review prompts.

Frequently asked questions

What are the best saas directories

The answer depends on your goal. For conversion trust, prioritize G2, Capterra, and TrustRadius. For launch visibility, plan a Product Hunt release. For switch intent, add AlternativeTo. For authority and PR readiness, maintain Crunchbase. Balance your mix so you cover awareness, consideration, and validation without stretching your team.

Which saas directories list software

Review marketplaces like G2, Capterra, and TrustRadius list thousands of SaaS products by category with verified peer reviews. AlternativeTo lists software by alternatives and tags. Launch platforms like Product Hunt list daily releases. Data directories like Crunchbase list companies with profiles and milestones.

Where can I find top rated SaaS platforms

Start with review marketplaces and filter by category, rating, and segment. Read both the most helpful positive and critical reviews to understand real fit — don’t rely solely on star ratings. Always check recent reviews for momentum and whether the product matches your specific use case.

Most of the top-rated SaaS platforms can also be found on our LaunchDirectories homepage, where we curate the best listings in one place.

Who offers the best software directory services

Look for directories with verified reviews, clear category pages, and transparent scoring. The best choice for you is the platform whose audience matches your ICP. If you sell into mid market, a directory with strong SMB traffic may not convert well. If you sell enterprise, long form reviews and detailed comparisons carry more weight.

Are there specialized saas directories

Yes. You will find specialized directories for AI, data, developer tooling, no code, design, security, and more. Use them as a complement to the big marketplaces. Specialized directories often have smaller audiences but higher intent within their niche.

Show me top SaaS platforms for startups

Instead of a single top list, filter by your startup needs. For early traction, launch on Product Hunt and capture signups. For credibility, seed reviews on one review marketplace that matches your ICP. For investors and partners, make sure your Crunchbase profile is complete and accurate.

What software directories are popular

The directories covered in this guide consistently show up in buyer journeys and industry conversations. Your exact mix should reflect your product stage and category maturity. Keep testing and measuring until you find the smallest set that drives reliable results.

Putting it all together for a global starup team

Even if your buyers are primarily in the United States, the plan above works globally. Directory audiences are international, and the same principles apply across regions.

Localize examples and pricing where needed, but keep one global profile strategy so your team can submit once and maintain efficiently.

The phrase best saas directories should not push you toward a one size fits all list. Use it as a lens to compare intent, category fit, and maintenance, then decide what to execute next quarter.

Final action plan

Build the single source of truth for copy and assets this week

Choose a three plus one plus one plus one mix that covers reviews, launch, alternatives, and data

Run a two week submission sprint and an eight week optimization cycle

Start a sustainable, ethical review flow with two or three natural ask moments

Track rank movement, review velocity, and assisted conversions monthly

Revisit category fit and messaging each quarter and refresh visuals at least twice a year

If you want a faster path, our team can handle manual submissions at scale and help you prioritize by authority and intent so you get impact quickly without burying your marketers in forms.

We can help you!

Want help getting listed everywhere that matters and turning those profiles into pipeline and links that compound?

We can submit your product to 100 plus directories, maintain profiles, and set up an ethical review engine that fits your motion. Tell us about your product and goals and we will shape a plan that fits your timeline and resources.

The phrase best saas directories is only useful when backed by a clear, stage appropriate strategy. Let us help you build it.

Ready to build high-quality backlinks?

We'll submit your product to 100+ directories and build valuable backlinks for your SEO. Save hours of manual work so you can focus on what's important — selling and building, not submitting boring forms.